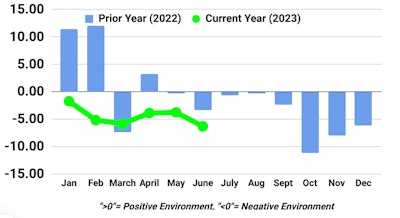

Two separate assessments of trucking market conditions showed weaknesses recently, hitting smaller carriers the hardest.

Both FTR's Trucking Conditions Index and the American Trucking Associations' For-Hire Truck Tonnage report showed decreases in June, continuing softening conditions for much of the year.

FTR said its index for June fell to -6.29 from the previous -3.75, reflecting modestly weaker market conditions for carriers. Freight rates were slightly less negative, but all other key factors deteriorated, according to FTR. June’s TCI reading was the most negative since November.

“Based on our assessment, for-hire trucking companies have already faced the longest period of consistently unfavorable market conditions since the Great Recession," said FTR's Vice President of Trucking Avery Vice. "We expect negative TCI readings to continue for nearly a year longer and little, if any, improvement until early 2024. As we have noted before, the challenges are not uniform as the current market is hitting small carriers much harder than larger ones, especially considering the recent upturn in diesel prices.”

FTR's index tracks the changes representing five major conditions in the U.S. full-load truck market. The major conditions are:

- freight volumes

- freight rates

- fleet capacity

- fuel price

- financing.

- A positive score represents good, optimistic conditions

- A negative score represents bad, pessimistic conditions

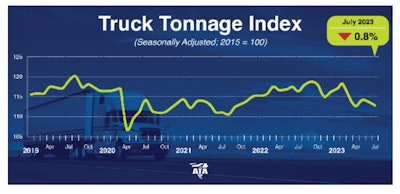

ATA's advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 0.8% in July after falling 0.3% in June. In July, the index equaled 112.9 (2015=100) compared with 113.8 in June.

“Headwinds for freight remained in July, pushing the truck tonnage index lower,” said ATA Chief Economist Bob Costello. “As has been the case for several months, a multitude of factors have caused a recession in freight, including sluggish spending on goods by households as consumers traveled more and went to concerts this summer. Less home construction, falling factory output and shippers consolidating freight into fewer shipments compared with the frenzy during the goods buying spree at the height of the pandemic are also significant drags on tonnage.”

Compared with July 2022, the SA index fell 3%, which was the fifth straight year-over-year decrease. In June, the index was down 3.2% from a year earlier.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s.

Alabama Trucking Association

Alabama Trucking Association