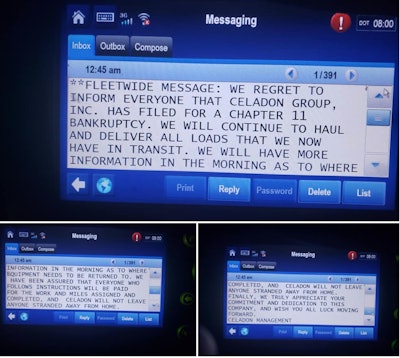

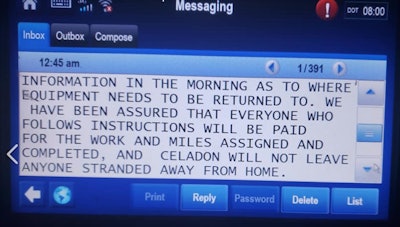

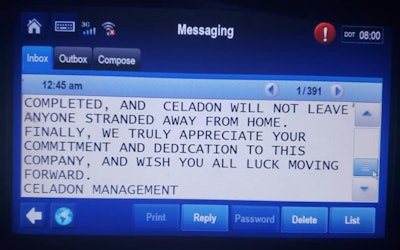

Celadon Group announced at midnight on Sunday that it will cease operations and file Chapter 11 bankruptcy. The company said it will close all business units Monday, Dec. 9, except for its Taylor Express subsidiary operated out of Hope Mills, North Carolina.

The Indianapolis-based company, which was founded in 1985 with 50 trucks, operates more than 3,300 trucks and tractors. The company went public in 1994.

Messages deployed to drivers Saturday indicated that the company’s fuel cards were down, but later messages indicated the issue had been corrected.

“Celadon has faced significant costs associated with a multi-year investigation into the actions of former management. When combined with the enormous challenges in the industry, and our significant debt obligations, Celadon was unable to address

Since 2017, Celadon had been trying to rebound from a scandal that rocked the company’s financials. The news of the company’s closure comes just days after its former chief operating officer, William Eric Meek, and its former chief financial officer, Bobby Lee Peavler, were charged by the Department of Justice on counts of securities fraud, wire fraud, bank fraud and lying to investigators. Another former employee, Danny Williams, pleaded guilty in May to criminal charges as part of the same scandal.

The New York Stock Exchange halted trading of Celadon stock in mid-2017 after the company pulled required financial filings.

Celadon pulled the forms after an independent auditor found major discrepancies in the company’s financial reports, with Celadon later reporting that it had overstated its income by as much as $250 million for 2014, 2015 and 2016. The over-reported income was based on an alleged scheme in which former leadership at Celadon sold used trucks at an inflated price to third parties, then bought back the trucks at those inflated prices as a way to avoid recording losses on equipment sales.

The company hasn’t filed quarterly earnings reports for any quarter since late 2017. In its most recent filing, for the first quarter of 2017, Celadon reported a loss of $10 million. The company has since paid a $42 million fine to settle a criminal probe brought by the Securities and Exchange Commission and the Department of Justice. The company also paid $5.5 million to settle lawsuits brought in the wake of its de-listing.

In September of 2017 the company announced it was closing its CDL training schools and selling off its flatbed division.

In September of this year, Celadon announced it had secured $165 million in financing intended to refinance its debt and replace aging company equipment. The same month, the company also announced the hiring of former Swift CEO Richard Stocking to help lead its turnaround efforts.

–Jason Cannon, Matt Cole, David Hollis and James Jaillet contributed to this report.